NEWS

21-09-2021 by redazione

During the pandemic period, the government's decision to add a new tax, the 'minimum tax', to the tax burden of large Kenyan companies caused a stir.

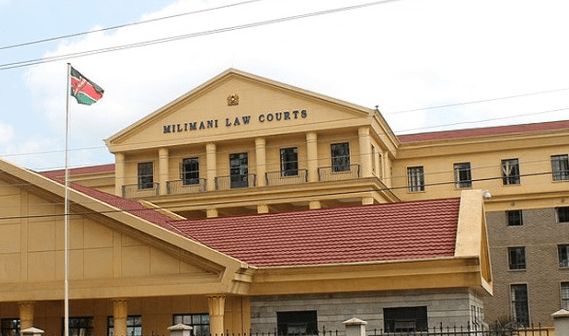

There had been many protests from the various categories of entrepreneurs and some associations and representatives of civil society had decided to turn to the courts.

Today, on the eve of the payment of the tax, which would correspond to one per cent of the gross turnover of any company registered in Kenya, even without a positive balance sheet, the High Court of Machakos has denied the Kenya Revenue Authority the right to apply the minimum tax and be paid by local companies.

Judge George Odunga declared this income tax unconstitutional.

In particular, the court accepted the Kitengela Bar Owners Association's (KBAO) plea that one of the articles, which would allow the tax authorities to levy one per cent of gross receipts every three months, is unenforceable, even for companies that do not make a profit.

KBAO was followed by several other associations in Nairobi and other cities.

At this particular time in history, with the economic crisis exacerbated by the pandemic, the move by the National Assembly, which did not involve the Senate in its decision, seemed at least ill-advised.

The law's drafters defended themselves by explaining that the new tax would protect the State from the many 'tax cheats' who would take advantage of the moment to rig budgets, using the pandemic as an alibi and declaring budgets at a loss even when they are not.

The Machakos High Court used a very relevant metaphor to explain why the 'minimum tax' was rejected: 'The National Assembly has identified a "Virus" that can infect the revenue collection system. This virus would be dishonestly declaring losses in the budget. But it has developed an inadequate vaccine to deal with this fiscal pandemic; the proper solution would be to develop "antibodies" to punish only the guilty, not to operate with a generic solution that would indiscriminately hit even the honest".

The government will now have to reformulate a fair proposal that does not burden those who already pay taxes regularly, but which succeeds in identifying the cunning.

NEWS

by redazione

The planned increase in entrance fees to Kenya's national parks and marine reserves by...

A second petition against the reckless increases in paperwork and documents for Kenyans and...

The difficult period for the Kenyan economy may have reached its climax and now begin its downward...

The Malindi Court of Appeal was rated as the best in Kenya by the annual Justice Report, drawn up and made public by Justice Chief and President of the Supreme Court of Kenya, David Maraga.

With a "very good" rating,...

EDUCATION

by redazione

The High Court has temporarily suspended the government's recent directive that would require...

NEWS

by redazione

This also happens in Kenya: the national head of the Tax Office, the Kenya Revenue Autjority, was...

INVEST IN KENYA

by Freddie del Curatolo

We have long argued that Western companies with big retail aspirations should explore the possibilities...

POLITICS

by redazione

The ruling opposition is calling on the people to "disobey" the new restrictive measures signed...

TOURISM

by redazione

A proposal to boost tourism in Kenya but at the same time the economy that...

POLITICS

by Freddie del Curatolo

Even with all the differences, cosmic distances, continental drifts and meanings of the word 'democracy', I...

POLITICS

by redazione

Among all the possible institutional or associative components of Kenya that were awaited today at the Supreme Court, Harun Mwau, a former member of parliament and constitutionalist, has emerged....